Living Here

- Pets and Animals

- Residents

- Report

- Environment

- BackEnvironment

- Air Quality

- Biodiversity

- Biosecurity

- Blue-green algae blooms

- Bushfire Mitigation

- Coasts and Coastal Vegetation

- CoastSnap

- Conservation Programs and Initiatives

- Erosion and Sediment Control

- Feral Animals

- First Nations Fire and Land Officer

- Landfill Gas Abatement

- Mosquitoes

- Pests and Weeds

- Weed Spray Equipment Hire

- Wildlife

- Community Development

- Community Investment

- Services

- Emergencies

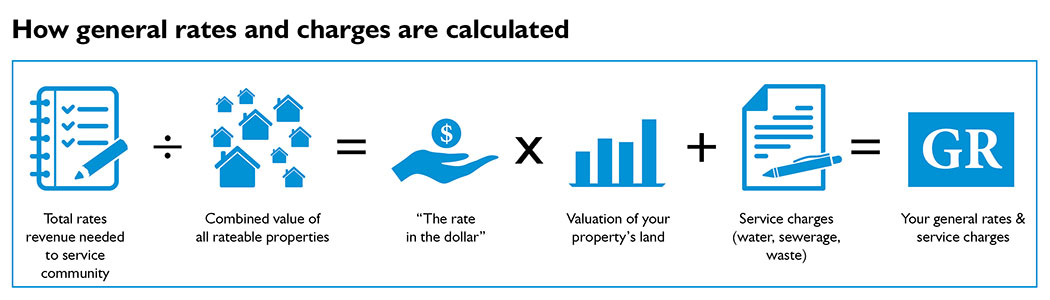

How rates are calculated

Some of the factors Council look at to determine how your rates are calculated include the determination of the total rates revenue needed to service the community.

We then divide that through the total valuation of all rateable properties to determine the “general rate” or calculated rate in the dollar.

Council then takes 'your property’s land valuation' x 'general rate' = and this becomes 'the rate component of your bill' + Services charges (water, sewer and waste) + State Emergency Management Levy + Water consumption = will be your “Rates and charges Notice/Bill”

The required rates revenue is therefore spread across the community according to the distribution of its properties' values.

A reduction or increase in a community's property values does not necessarily result in an equal reduction or increase in the costs of providing services to that community.

This distribution of property values across a community typically fluctuates from year to year.

The Queensland State Valuation Service is responsible for valuing all properties in the region. Any valuation enquiries should be directed to 1300 664 217.

The fixed cost of providing services, combined with uneven levels of property value changes from year to year, explains why a drop or rise in a property's value doesn't necessarily result in an associated drop or rise in your August Rates and Charges Notice.

A rate cap is also applied to reduce the impact of large valuation increases on residential, rural, small businesses and light industrial properties.

Land valuations 2023

The Gladstone Region has received a revaluation on its properties this year. The land valuations are based on valuations completed by The Queensland State Valuation Service for our Regional Council’s Local Government Area on 1 October 2022, and these valuations are effective from 30 June 2023. They will be used by Council as a component in the calculation of its rates and charges for 2025/2026.

The Valuer-General provides independent advice and transparency in the assessment and issuing of statutory land valuations for all rateable properties in Queensland, in accordance with the Land Valuation Act 2010.

When lands are valued, they are normally assessed annually as of 1 October, with notices issued by 31 March in the following year. The new valuations take effect for local government rating on 30 June in the year the notice is issued.

For land valuation enquiries, including details about lodging an objection, contact the State Valuation Service on 1300 664 217. Alternatively, information is available online.

Rate cap

A rate cap is designed to buffer increases in rates on residential and rural land that may arise due to large land valuation increases. This means that irrespective of any large change to your valuation, general rates will only increase by the cap percentage on the previous year. A rate cap applies to businesses and commercial and light industrial properties. Refer to the Revenue Statement for the applicable rate cap.

The rate cap will not apply when a subdivision, re-survey or amalgamation of the lot has occurred.

Supplementary Notice

Council issues supplementary rate notices when there has been a change to the rating record since the last annual rate notice. For example, when a dwelling is completed or a new garbage collection service is added.

Budget 2025/26

Gladstone Regional Council has adopted its 2025/26 Operational Plan and Budget, committed to meeting the needs and challenges facing our community both now and into the future.

This year’s $369.1M Budget focuses on improving the region’s liveability and sustainability in a practical and well-thought-out manner that delivers results for the Gladstone Region.

It strikes the balance between ensuring the community has access to reliable infrastructure across the region’s roads, water and sewerage networks, while ensuring open spaces and community facilities meet the needs of our growing community.

Budget 2025/26 Special Budget Meeting Minutes Rates and Charges 2025/26

Revenue Statement

The Revenue Statement has been prepared using the guidelines set out in Council's adopted Revenue Policy. Council's Revenue Statement will state:

a) if the local government levies differential general rates –

b) if the local government levies special rates or charges for a joint government activity - a summary of the terms of the joint government activity; and

c) if the local government fixes a cost-recovery fee - the criteria used to decide the amount of the cost-recovery fee; and

d) if the local government conducts a business activity on a commercial basis - the criteria used to decide the amount of the charges for the activity's goods and services.

In addition, Council's Revenue Statement must include for the financial year:

a) an outline and explanation of the measures that the local government has adopted for raising revenue, including an outline and explanation of –

i. the rates and charges to be levied in the financial year; and

ii. the concessions for rates and charges to be granted in the financial year;

b) whether the local government has made a resolution limiting an increase of rates and charges.

Living Here

- Pets and Animals

- Residents

- Report

- Environment

- BackEnvironment

- Air Quality

- Biodiversity

- Biosecurity

- Blue-green algae blooms

- Bushfire Mitigation

- Coasts and Coastal Vegetation

- CoastSnap

- Conservation Programs and Initiatives

- Erosion and Sediment Control

- Feral Animals

- First Nations Fire and Land Officer

- Landfill Gas Abatement

- Mosquitoes

- Pests and Weeds

- Weed Spray Equipment Hire

- Wildlife

- Community Development

- Community Investment

- Services

- Emergencies

Gladstone Regional Council

Connect. Innovate. Diversify.

Get in Touch

Phone

(07) 4970 0700

Opening Hours

8.30am - 5pm Monday to Friday

Social media

Postal Address

PO Box 29, Gladstone Qld 4680

Council Offices

101 Goondoon Street, Gladstone Qld 4680

3 Don Cameron Drive, Calliope Qld 4680

41 Blomfield Street, Miriam Vale Qld 4677

Cnr Wyndham & Hayes Avenues, Boyne Island Qld 4680

Rural Transaction Centres

71 Springs Road, Agnes Water Qld 4677

47 Raglan Street, Mount Larcom Qld 4695

Footer Acknowledgement

Gladstone Regional Council would like to acknowledge the Bailai, the Gurang, the Gooreng Gooreng and the Taribelang Bunda people who are the traditional custodians of this land. Gladstone Regional Council would also like to pay respect to Elders both past, present and emerging, and extend that respect to other Aboriginal and Torres Strait Islander people. Learn more about Council's Reconciliation Action Plan (RAP).

Chat Popup

All content © Gladstone Regional Council. All Rights Reserved.

Back to the top